Leading foreign brokerages, such as Goldman Sachs, Morgan Stanley and Barclays, are upbeat on the Indian equity markets for 2024, even as they remain watchful of global geopolitical developments, crude oil prices, and central bank policies, which may sway investor sentiment.

The upcoming general elections in April/May 2024 are expected to add volatility to the Indian markets, keeping investors on their toes.

While Morgan Stanley presents its bull-case (30 per cent probability) scenario with the BSE Sensex at 86,000 in by the end of 2024, Goldman Sachs predicts the Nifty50 index to reach 21,800 by the end of next year, up nearly 11 per cent from the current level of 19,694.

Goldman Sachs, according to a recent note, believes 2024 will be a year of two halves: Pre-elections, when government spending will fuel growth; and post-elections, when investment growth, particularly from the private sector, will pick up pace.

India Inc’s profit, according to Goldman Sachs analysts, is likely to grow at 15 per cent in 2024, and 14 per cent in 2025, with growth spread across sectors.

‘We raised India to overweight in our regional allocations. India has the best structural growth prospects in the region. equity returns are likely to be back-loaded given the tough global backdrop and political uncertainty as the election approaches in the second quarter of the calendar year 2024 (Q2CY24),’ wrote Andrew Tilton, chief Asia-Pacific economist and head of EM economic research at Goldman Sachs in the note co-authored with Santanu Sengupta and Arjun Varma.

‘In 2024, we expect macroeconomic resilience to continue (in India) amid steady growth at 6.3 per cent year-on-year,’ they added.

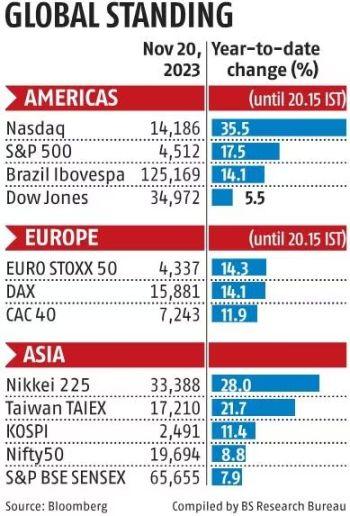

Despite the challenging global geopolitical landscape, bond yields, central bank policy action, and crude oil prices, Indian equities have shown remarkable resilience in 2023.

The S&P BSE Sensex and the Nifty50, this year so far, have risen by around 8 per cent and 9 per cent, respectively.

Gains in the midcap and smallcap indices (both BSE) have been sharper with both rallying 32 per cent and 37 per cent, respectively, shows data.

Morgan Stanley analysts also have high expectations for Indian equities in 2024, as the market is likely to price in continuity and a majority government after the general elections.

However, they caution that a further rise in oil prices, especially above $110 a barrel, could create macroeconomic headwinds.

S&P BSE Sensex earnings, they said, are estimated to grow at a compound annual rate of 21.5 per cent between FY23 and FY26.

‘Our base case (50 per cent probability) pegs the S&P BSE Sensex at 74,000. Here, we assume continuity in a government with a majority mandate, robust domestic growth, the US does not slip into a protracted recession, and benign oil prices,’ wrote analysts at Morgan Stanley, led by Ridham Desai, their head of India research and India equity strategist, in a report co-authored with Sheela Rathi and Nayant Parekh.

‘Government policy remains supportive, and the Reserve Bank of India executes a calibrated exit from its current hold stance (on policy rates). Our bull-case (30 per cent probability) scenario sees the BSE Sensex at 86,000 in 2024,’ the Morgan Stanley analysts added.

UBS, however, is not as bullish. Its analysts predict flattish returns for emerging markets and Asia ex-Japan equities in the first half of 2024 due to a potential slowdown in the US.

‘We are underweight (on) expensive markets, such as India (retail flows could be at risk with higher rates, hurts from higher oil) and Thailand (weaker support from domestic momentum pending fiscal stimulus, weak bottom-up analyst outlook),’ wrote Sunil Tirumalai, emerging markets and India Strategist at UBS Securities in a recent note.

Barclays, on the other hand, appears bullish on Indian equities.

It said in a recent note that the relative strength of Indian equity returns (absolute and risk-adjusted) compared to that of global peers, lower correlations to developed markets, and expected GDP growth of at least 6 per cent over the next five years warrant increasing exposure to India through active or passive means.

Current valuations are not cheap, but they look reasonable relative to their own history and are partly justified by competitive earnings growth.

Feature Presentation: Aslam Hunani/Rediff.com

Source: Read Full Article